Featured Post

How To Determine Cost Basis Of Bitcoin

- Get link

- X

- Other Apps

The cost basis can be calculated by taking the full cost of the 025 BTC txn ID 1 and half of the cost of the second 050 BTC transaction ID 2. The cost basis can be calculated by taking the full cost of the 025 BTC txn ID 1 and half of the cost of the second 050 BTC transaction ID 2.

Free Bitcoin Tax Calculator Crypto Tax Calculator Zenledger

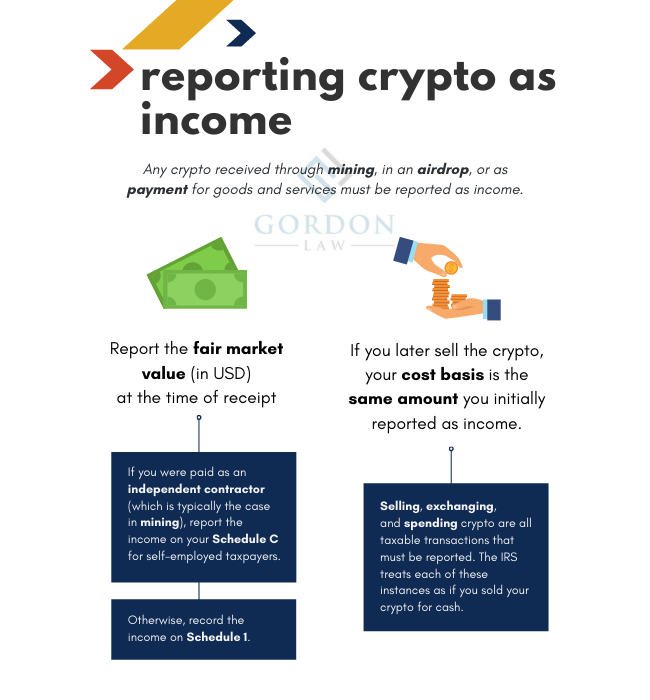

Cost basis should be calculated by summing up all the money spent to acquire the crypto including fees commissions and other acquisition costs in US.

How to determine cost basis of bitcoin. Basis in Ripple after Exchange. The results are the following. Your capital gainslosses are determined by the difference between the cost basis and the price you sell your capital asset.

1600 1600 8 1728 this is your Cost Basis. BitcoinTax uses a daily price of 277. FIFO First in first out for example would choose the earlier BTC buy as the cost basis for that sale three years later leading to a 9000 profit.

To calculate crypto cost basis there is a simple equation to follow. I filled down to replicate the function in all of the rows. Total number of contracts shares bought 1st contract amount 2nd contract amount 3rd contract amount.

You will report that as income for 2017 and pay the appropriate taxes. Accounting methods like FIFO LIFO and Minimization determine which cost basis is used in the above case. 100 5002 350 USD Transaction 4.

This will give you the average price of what you paid for every coin also known as the cost basis. You can also deduct the cost of any fees associated with selling your Bitcoin so if it cost you another 30 to sell it then you would report that as a deductible fee against the gain and reduce the capital gain to 794000. Calculate the total extra income from cryptocurrency.

Take the original investment amount 10000 and divide it by the new number of shares you hold 2000 shares to. Electricity Expenditures Cost Basis. Take your previous cost basis per share 10 and divide it by the split factor of 21 10002 5.

200 includes transaction fees Price of Bitcoin at exchange. For example if you buy 1 BTC in 1000 and 1 BTC for 12000 the next year and then sell 1 BTC three years later for 10000 in 2020 which cost basis do you use. To calculate the average price you need to know the total contracts shares quantity and the purchase price of each contract share.

To accurately submit your tax filings you need to know the cost basis of each of your transactions. You should report the BCH as income for a market value eg. For cost basis enter the 266 Bitcoin Cash value received per unit as you previously reported it as Other Income on line 21 of your 2017 Form 1040.

The data in column G serve as the cost basis for each transaction. I stretched the bordering box around cell G2 by dragging the square box in the lower right corner down to cell G19. Sell 025 BTC.

Purchase Price of Crypto Other fees Cost Basis For mining. In laymans terms this simply means what was the amount of dollars you originally spent to buy your bitcoin and what was the dollar value when you sold it. For example suppose that you invested 150 into Bitcoin on April 1 2021 for 6537 with a 149 transaction fee.

For crypto-to-crypto trading. The IRS requires taxpayers to report their cost basis and proceeds when they trade or sell capital assets such as Bitcoin. Taxable Gain on Sale.

How to Calculate Coinbase Cost Basis Take the invested amount in a crypto coin add the fee and divide by the number of coins that you have in other words Purchase Price Fees Quantity. When you sell those BCH you can subtract the proceeds from this cost basis which is. Purchase Price Fees Quantity.

The holding period for these units of Bitcoin. Because the fee was a cost of acquiring the Bitcoin you add it to your basis which becomes in fact 2030. This also becomes the cost basis.

How to Calculate Coinbase Cost Basis. You paid a brokerage fee of 8. 100 5002 350 USD Transaction 4.

Simply put your cost basis is what you paid for an investment including brokerage fees. Lets say you bought 05 Bitcoins in December 2018 for 1600. Sell 025 BTC.

That means your gain is actually only 797000. Simple Cost Basis Formula. Basis in Bitcoin after Exchange.

You can calculate your cost basis per share in two ways.

Bitcoin Rise What Is Cryptocurrency Trading Bitcoin Stock Chart Yahoo Bitcoin Bank Prediction Of C Best Cryptocurrency Cryptocurrency What Is Bitcoin Mining

Infographic Crypto Currency Trading Terms Crypto Blockchain Bitcoin Fomo Altcoin F Crypto Currencies Blockchain Cryptocurrency Cryptocurrency Trading

Deducting Exchange Fees On Crypto Taxes Taxbit Blog

Your Crypto Tax Questions Answered Lexology

Crypto Custody And Custodian Cryptocurrency Bitcoin Cryptocurrency Bitcoin

Best Crypto Tax Software Reviews 2021 Tax Season Picnic S Blog

Proper Cryptocurrency Cost Basis Assignment Methods Taxbit Blog

Proper Cryptocurrency Cost Basis Assignment Methods Taxbit Blog

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

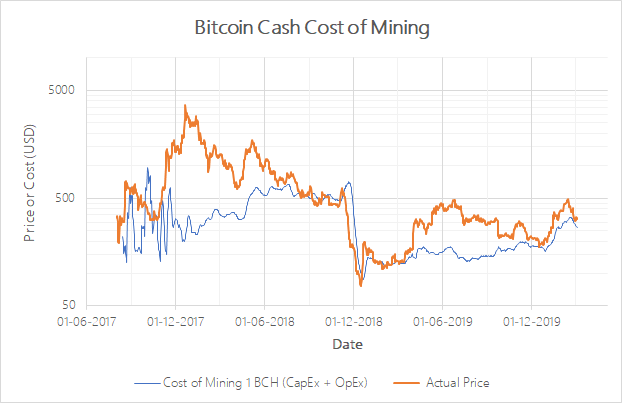

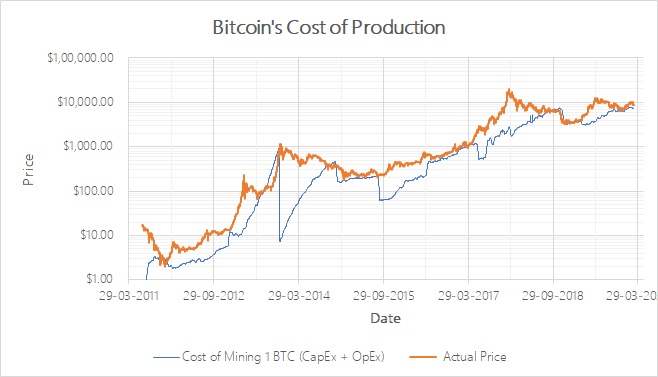

Bitcoin S Cost Of Production A Model For Bitcoin Valuation By Data Dater Coinmonks Medium

How To Determine The Blockchain App Development Cost Blockchain Blockchain Cryptocurrency Link And Learn

How To Lower Your Crypto Tax Bill Which Cost Basis Method Is Best Cointracker

Your Crypto Tax Questions Answered Lexology

![]()

Cointracking Crypto Tax Calculator

Coinbase Has Made A Tax Calculator For Traders Bitcoin Price Tax Preparation Free Money

Bitcoin S Cost Of Production A Model For Bitcoin Valuation By Data Dater Coinmonks Medium

Deducting Exchange Fees On Crypto Taxes Taxbit Blog

Your Crypto Tax Questions Answered Lexology

Comments

Post a Comment